Do you have questions about capital credits?

Why should you care?

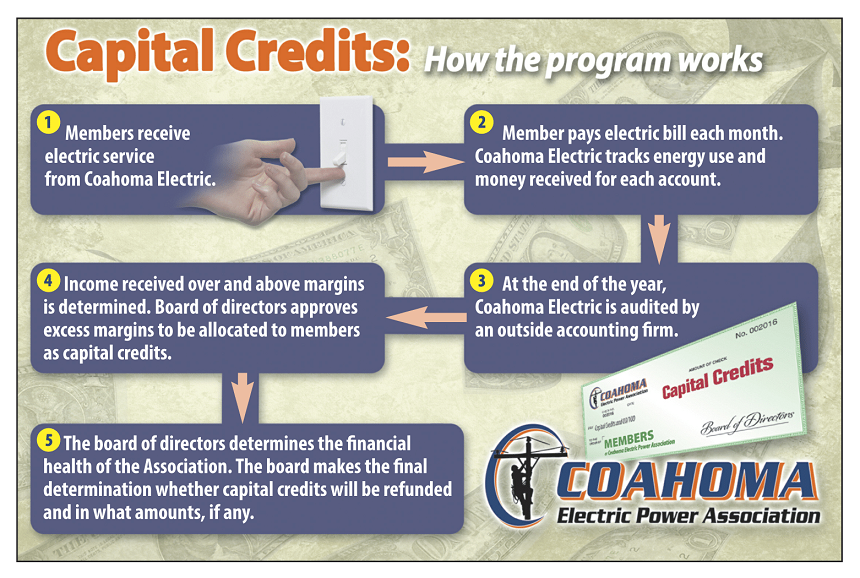

So what does this tidbit of information mean to you? Coahoma Electric Power Association is owned by those it serves. It is devoted to improving the lives of those it serves by improving the standard of living of each and every member. Coahoma Electric Power Association is a not-for-profit organization committed to bringing you electricity at the lowest possible cost.

What does not-for-profit mean?

All revenue collected in excess of expenses (the margin) is ultimately returned to you and the other members who purchase electricity from the Cooperative. Your accumulated capital credits represent your current ownership in the Cooperative. To keep interest costs low, the Cooperative temporarily uses your capital instead of borrowing all funds for capital improvements. Capital Credits are not cash.

When will I get paid?

Each spring the board of directors evaluates the financial position of the Cooperative and considers a retirement or cash payment of capital credits. When the elected Board of Directors believe the returning of capital credits will not harm the financial strength of the cooperative they may choose to retire a portion of the capital.

Is it taxable?

If you’re wondering about income tax issues and capital credits, the only time you have to claim capital credits as income is when the check that you receive (not the allocation) includes charges that you claimed as tax deductible for your business or farm. For example, if you claimed 50% of your electric bill as a tax deduction in the year(s) retired, then 50% of your refund is taxable. If you have any questions, please call us. Our capital credit expert is Bob Burke, and he can be reached in Lyon at (662) 624-8321.